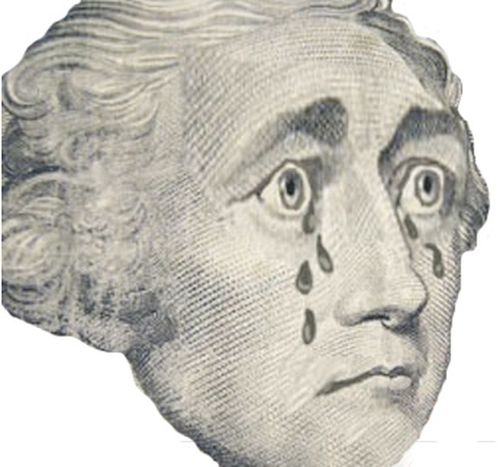

Five years of enlarged Europe – no longer a land of gold

Published on

Translation by:

Gemma TurnerFive years on from the great European expansion into the east, the eastern and western members are still oceans apart. The distance is not only geographical and the differences not only ideological

They say that Midas, the king of Phrygia, received a great gift from the wine god Dionysus to thank him for his hospitality towards the latter’s companion, Silenus. This gift was the ability to turn anything he touched into gold. The king was overjoyed; this gift promised to bring great riches, but it soon turned out to be a curse in disguise, as even the food that he needed to eat to survive turned into the brilliant, coveted, but entirely inedible metallic substance before his eyes.

Midas touch in Europe

In the first few years, after the eastern expansion of the EU, the new member countries appeared to be the promised lands that could turn any foreign investments into gold. These great, shining horizons became more attractive than even the asiatic paradigms. This allure brought many western banks into the east, like moths to a flame, with Austrian banking leading the way. western banking clung to this market like a predator that has just caught its prey. During 2007, almost half of the world’s foreign investment went to these countries, the majority being in banking bonds (more than 300, 000 million euros, or £264, 506 million).

In the first few years, after the eastern expansion of the EU, the new member countries appeared to be the promised lands that could turn any foreign investments into gold. These great, shining horizons became more attractive than even the asiatic paradigms. This allure brought many western banks into the east, like moths to a flame, with Austrian banking leading the way. western banking clung to this market like a predator that has just caught its prey. During 2007, almost half of the world’s foreign investment went to these countries, the majority being in banking bonds (more than 300, 000 million euros, or £264, 506 million).

Illusion of financial capitalism

This illusion, however, soon revealed itself to be nothing but a mirage. Common difficulties soon arose, financial risks became commonplace, demand dropped and therefore so did the amount off exports and weak currencies lost value. All of this provoked a sudden withdrawal of the foreign capital invested here. This sudden flight of the western countries and their investments, to attend to their own national, pressing needs, led to a gaping hole in the eastern market, systematic risk and far reaching problems.

Dyslexic loans

These paradises, to which the invading foreign investments came in the hope of making huge profits in record time, by turning everything they touched into gold, have faded away and all that now remains is ash and smoke. In times of prosperity, interest rates rise in order to help when we hit these times of crisis. This instigates local businesses to look for their loans in cheaper currencies, such as the euro, the Japanese Yen or Swiss Francs as they were then. But good rains leave mud – a massive foreign debt. So all the European banks, that have branches in central and eastern Europe view this accumulation of incessant problems and risks with great concern. Austrian banking, headed by Erste Bank, whose net profit has rose more than 30%, to 932 million euros (£822 million) in 2006, now finds itself in the eye of the storm because they have a great involvement and massive presence in that area.

New, devalued Europe

If, to all this, we add the devaluation of the Europe’s monetary units compared to the Euro it is clear to see why the future looks bleak. The Polish zloty lost 33% of its value, the Hungarian florin dropped more than 20% and the Czech corona had more than a 15% devaluation in relation to the eurozone (Poland, Hungary, Romania and the Czech Republic all having floating exchange rates) .

Taking all this into consideration it is not surprising that Joaquín Almunia, European commissioner for economic and monetary affairs, sees the situation that the central, eastern and southern European banks are facing as a great concern. As well as with the high risk situation in Romania, we must be aware that the Ukraine, Croatia and Serbia are now finding themselves facing some alarming realities. For this reason the EU is coming forward to announce that it is prepared to help, however they have immediately clarified that this aid will be different to that which is provided in the eurozone. But if the eastern financial system goes under, the west will undoubtedly follow.

Translated from Por qué sufren los países del Este